Malaysians can also enjoy more affordable protection coverage with the exemption of the stamp duty for insurance and takaful products including Perlindungan Tenang products with less than RM150 annual premiumcontribution for individuals and RM250 annual premiumcontribution for micro-SMEs. Generally it is easy to calculate stamp duty according to the rates provided by the Indian Stamp Act or the State.

Exemption For Stamp Duty 2020 Malaysia Housing Loan

In May 2014 there was a brief crackdown on visa runs meaning that if foreigners wish to re-enter Thailand after their visa-free or visa on arrival period has expired they have to obtain a visa in advance or remain outside Thailand at least for one night.

. Additionally under Budget 2022 Finance Minister Tengku Zafrul announced that the government will no longer impose Real Property Gains Tax or RPGT for property disposals by individuals comprising Malaysian citizens permanent residents and. It consists of over 200 chapters organized in six functional series. Motor vehicle acquisition tax.

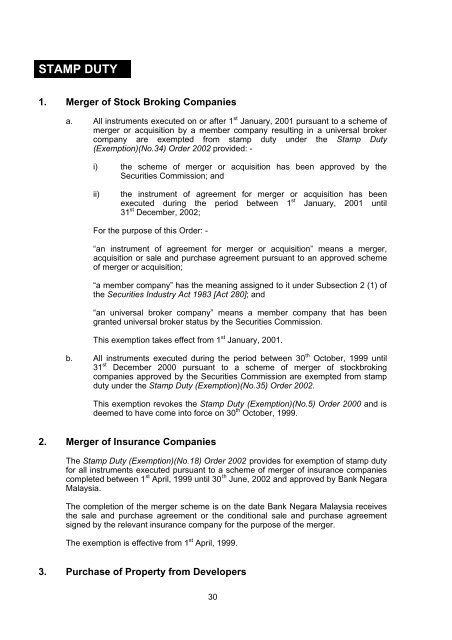

This exemption order applies to a retail investor who is an individual for instruments executed on or after 1 Oct 2012 and not. Stamp Duty Exemption for Insurance and Takaful Products. Stamp duty exemption under i-MILIKI.

Sections 99 103 106 and paragraph 341 Schedule 5 of the Income Tax Act 1967. Select the Brand from the drop-down list. Article 41 and Article 1211 of the Federal Constitution of Malaysia 1957.

6 Order 2022 Exemption of FSI received by resident companies LLP and individual in relation to a partnership business in Malaysia Based on the Exemption Orders the following categories and sources of FSI received in Malaysia from outside Malaysia are exempted from tax from 1 January 22 to 31 December 2026. Paragraph 11 2c Schedule 2 of Real Property Gains Tax Act 1967. Therefore when calculating the stamp duty fee you need to deduct RM2400 from the annual rental amount to determine the taxable rental.

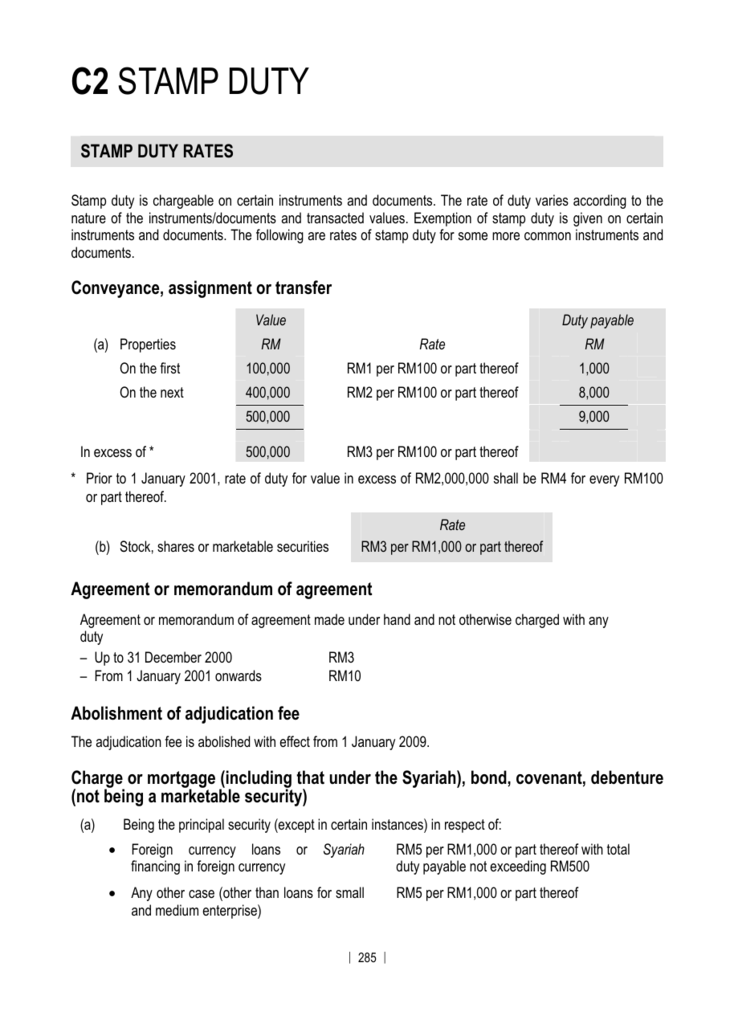

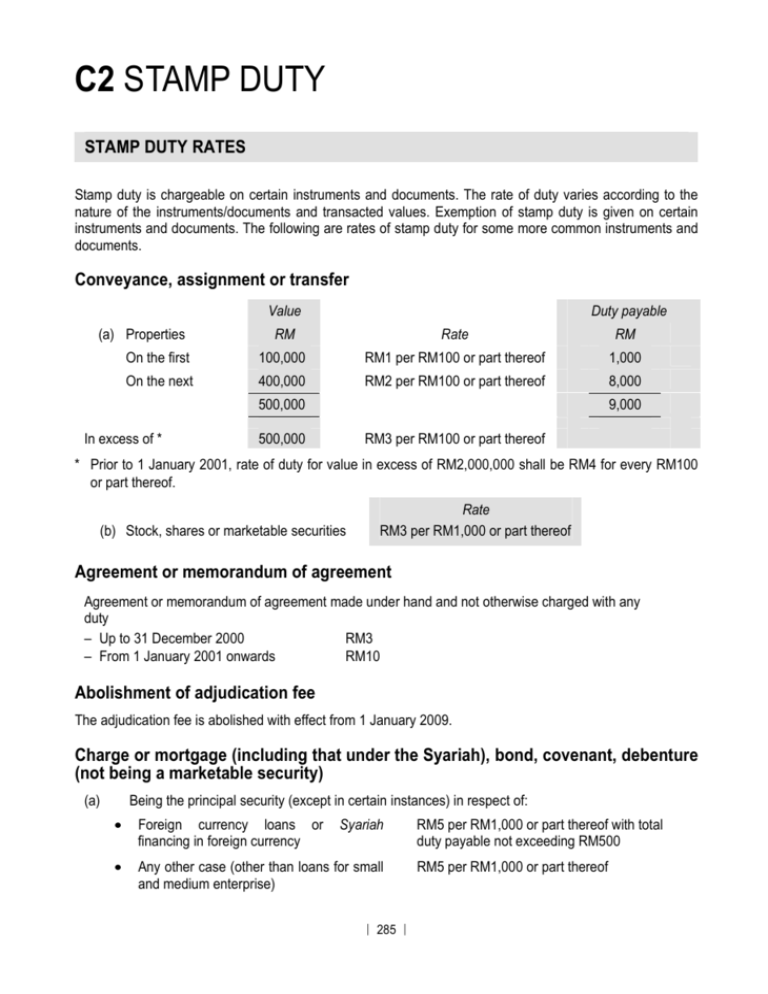

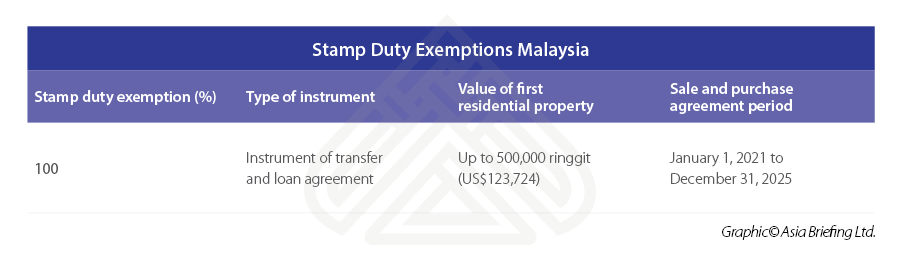

Calculating the stamp duty amount for your tenancy agreement isnt that hard. On 15 July 2022 the Malaysian government announced that first-time homebuyers will get a stamp duty exemption on the instrument of transfer and loan agreement under the Keluarga Malaysia Home Ownership Initiative i-MILIKI. System automatically displays the Tax Stamp Purchase Order Request Status.

Hong Kong stock is defined as stock the. The first RM2400 of your annual rental income is entitled for stamp duty exemption. An instrument relating to the sale and purchase of retail debenture and retail sukuk as approved by the Securities Commission under the Capital Markets and Services Act 2007 Act 671 are exempted from stamp duty.

Customs is an authority or agency in a country responsible for collecting tariffs and for controlling the flow of goods including animals transports personal effects and hazardous items into and out of a country. Stamp duty is charged on transfer of Hong Kong stock by way of sale and purchase at 026 of the consideration or the market value if it is higher per transaction. Agency Organization and Legal Affairs Programming Acquisition and Assistance Human Resources Management Services and Budget and.

Order 92 Rule 4 of the Rules of Court 2012. Both Acts were introduced to restrict the speculative activity of real estate. However according to Stamp Duty Remission Order 2003 all contract notes relating to the sale of any shares stock or marketable securities listed on a stock exchange approved under subsection 82 of the Securities Industry Act 1983 are waived from stamp duty exceeding MYR200 calculated at the prescribed rate in item 31 of the First Schedule.

Real Property Gains Tax RPGT is administered by Inland Revenue Board of Malaysia under the Real Property Gains Tax Act 1976 RPGTA 1976. Subsection 252 of Real. The stamp duty is to be made by the purchaser or buyer and not the seller.

Government of Malaysia V MNMN. I-MILIKI is a stamp duty exemption incentive that applies to instruments of transfers and loan. Tariffs and other taxes on import and export.

Then theres another revision to the RPGT under Budget 2020 as well as the Exemption Order for 2020. The Item Type is displayed based on the Item Type value selected in the Tax Stamp Purchase Order Request Form and it is non-editable. A foreign individual is subject to IIT VAT land appreciation tax and stamp duty plus some minor local taxes upon the disposal of real property in China.

If no exemption is applied the property tax paid can be used to offset against the profits tax payable by the corporation. Individuals are exempt from land appreciation tax for selling residential properties and exempt from stamp duty for purchasingselling residential properties. Traditionally customs has been considered as the fiscal subject that charges customs duties ie.

The ADS contains the organization and functions of USAID along with the policies and procedures that guide the Agencys programs and operations. Delay in payment of stamp duty can make the individual liable to pay a fine ranging from 2 to 200 of the total payable amount. Case Report Stay of Proceeding.

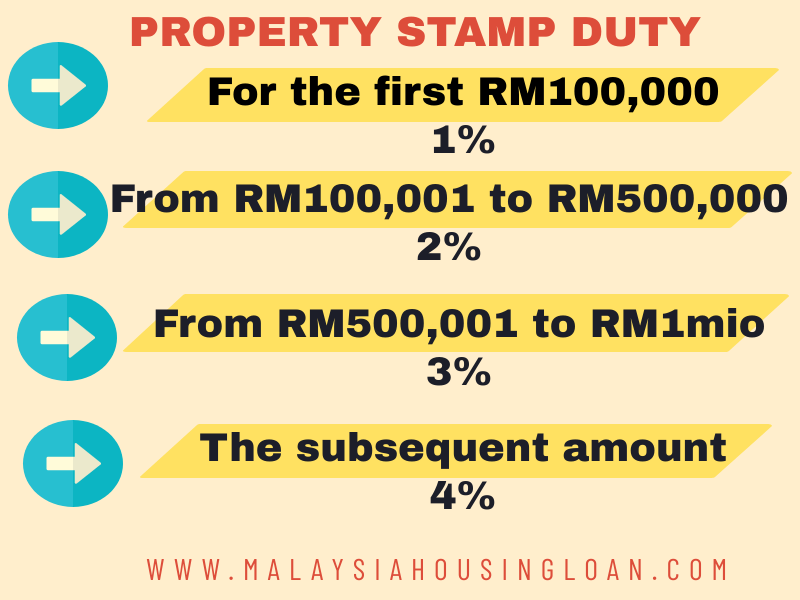

In August 2014 Thailand Prime Minister ordered the Immigration Police to be more flexible as the strict application of the law. Income Tax Exemption No. How To Calculate Stamp Duty In Malaysia.

In Application Details List section click to create the declared item details. RPGTA was introduced on 7111975 to replace the Land Speculation Tax Act 1974.

Stamp Duty For Transfer Or Assignment Of Intellectual Property Koo Chin Nam Co

C2 Stamp Duty The Malaysian Institute Of Certified Public

The 2019 Stamp Duty Exemption Property Insight Malaysia Facebook

Lee Lim Stamp Duty Exemption For Special Loan Facilities Facebook

C2 Stamp Duty The Malaysian Institute Of Certified Public

Lee Lim Stamp Duty Exemption For Special Loan Facilities Facebook

Stamp Duty Exemptions Malaysia Asean Business News

First Time Home Buyers To Enjoy Stamp Duty Exemption Mrt3 Project To Boost Construction Sector And More

2020 Stamp Duty Exemptions News Articles By Hhq Law Firm In Kl Malaysia

Lhdn Updates Stamp Duty Exemptions

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Latest Stamp Duty Charges 6 Other Costs To Consider Before Buying A House In 2019 Cbd Properties

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate Malaysia

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Ad Valorem Stamp Duty Damian S L Yeo L C Goh